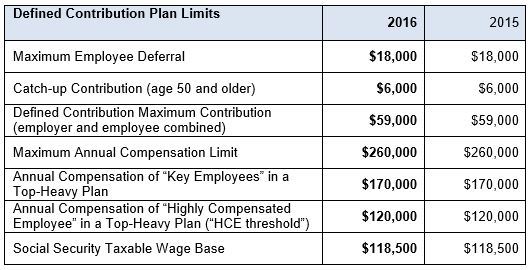

The Internal Revenue Service announced the cost-of-living adjustments (COLA) for tax year 2016, that apply to dollar limits for 401(k) and other retirement plans. Most of the plan limits will remain unchanged as the increase in the Consumer Price Index did not meet the statutory thresholds for that trigger rate adjustments.

The announcement highlighted the following:

- 401(k), 403(b) and profit-sharing plan elective deferrals will remain the same at $18,000. The catch-up contribution amount remains unchanged as well ($6,000).

- The annual defined contribution limit from all sources will stay at the lessor of $53,000 (plus the catch-up) or 100% of the employee’s compensation.

- The amount of employee compensation that can be considered in calculating contributions to defined contribution plans will remain at $265,000.

- The limit used in the definition of a highly compensated employee for the purpose of 401(k) nondiscrimination testing remains unchanged at $120,000.

The limits for SIMPLE and SEP plans are as follows:

The limit on annual contributions to an Individual Retirement Account (IRA) will stay at $5,500. The additional catch-up contribution limit for those ages 50 and over will remain $1,000.

You may visit the IRS Chart of Dollar Limitations on Benefits and Contributions for other amounts. Please contact us if you have any questions or concerns. Reprinted from Greenwalt.